Quantitative Investment Analysis - Chapter 1

In this post we will solve the end of the chapter practice problems from chapter 1 of the book.

Here are the first 6 problems and their solutions in R

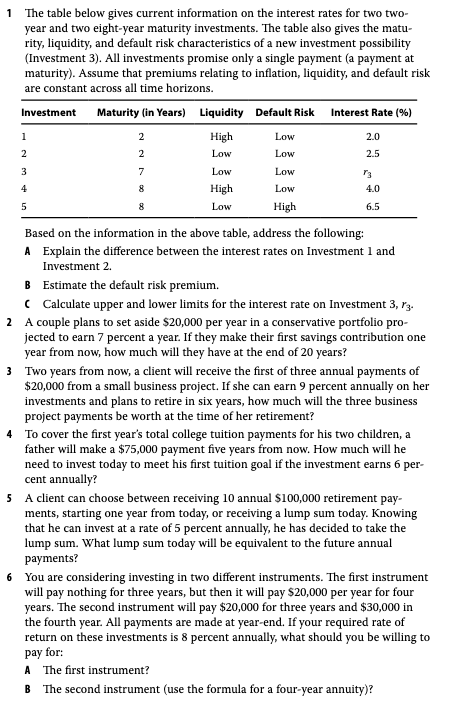

Problem 1A

Investment 1 and 2 have the same maturity and default risks. However investment 2 has low liquidity and therefore investment 2 has a higher interest rate of 0.5% to compensate for the liquidity risk. This is the liquidity risk premium.

Problem 1B

Investment 4 and 5 have the same maturity (8 years). We know from problem 1 the liquidity risk premiums is 0.5%. The interest rate difference between Investment 4 and 5, is 2.5%. Investment 5 has low liquidity and high default risk therefore it has a higher interest rate. Since we know 0.5% is the liquidity premium, we can attribute 2.5% - 0.5% = 2% as default risk premium.

Problem 1C

Investment 2 and 3 has the same liquidity and default risk, but investment 3 has a higher maturity hence it should have atleast 2.5% as the lower bound. Investment 3 and 4 has low default risk. But investment 3 has a lower maturity and lower liquidity. We know the liquidity premium is 0.5%, but we don’t know the compensation for extra year of maturity. Therefore we could expect the interest rate for investment 3 to be between 2.5% and 4.5%.

Problem 2

library(tidyverse)

savings <- 20000

interest <- 7/100

years <- 20

timeline <- rep(20000,years)

# Create a function to calculate the future value

# of payments

get_payment_fv <- function(x,y) {

payment <- (1 + interest) ^ (years - y) * x

return(payment)

}

payments <- map2_dbl(.x = timeline,.y = 1:years,

.f = get_payment_fv)

print(timeline)## [1] 20000 20000 20000 20000 20000 20000 20000 20000 20000 20000 20000

## [12] 20000 20000 20000 20000 20000 20000 20000 20000 20000print(payments)## [1] 72330.55 67598.65 63176.30 59043.27 55180.63 51570.68 48196.90

## [8] 45043.83 42097.04 39343.03 36769.18 34363.72 32115.63 30014.61

## [15] 28051.03 26215.92 24500.86 22898.00 21400.00 20000.00cat("The couple will have", paste0("$",round(sum(payments),2)),

"at the end of 20 years.")## The couple will have $819909.85 at the end of 20 years.Problem 3

cash_flow <- c(0, 0, 20000, 20000, 20000, 0, 0)

interest <- 9/100

years <- length(cash_flow)

payments <- map2_dbl(.x = cash_flow,

.y = 1:years,

.f = get_payment_fv)

cat("The client will have", paste0("$",round(sum(payments),2)),

"at the end of 6 years.")## The client will have $77894.21 at the end of 6 years.Problem 4

college_fee <- 75000

interest <- 6/100

years <- 5

pv <- (1 + interest) ^ (-years) * college_fee

cat("The father will need to invest", paste0("$",round(pv,2)),

"today to have $75000 in 5 years at 6%")## The father will need to invest $56044.36 today to have $75000 in 5 years at 6%Problem 5

interest <- 5/100

years <- 10

df <- tibble(year = 1:years,

cf = rep(100000,10)) %>%

mutate(pv = cf / (1 + interest)^ year)

print(df)## # A tibble: 10 x 3

## year cf pv

## <int> <dbl> <dbl>

## 1 1 100000 95238.

## 2 2 100000 90703.

## 3 3 100000 86384.

## 4 4 100000 82270.

## 5 5 100000 78353.

## 6 6 100000 74622.

## 7 7 100000 71068.

## 8 8 100000 67684.

## 9 9 100000 64461.

## 10 10 100000 61391.lump_sum <- sum(df$pv)

cat("The client should expect", paste0("$",round(lump_sum, 2)), "payment today.")## The client should expect $772173.49 payment today.Problem 6A

cf1 <- c(0,0,0,rep(20000,4))

interest <- 8/100

df <- tibble(year = 1:length(cf1),

cf = cf1) %>%

mutate(pv = cf / (1 + interest)^ year)

print(df)## # A tibble: 7 x 3

## year cf pv

## <int> <dbl> <dbl>

## 1 1 0 0

## 2 2 0 0

## 3 3 0 0

## 4 4 20000 14701.

## 5 5 20000 13612.

## 6 6 20000 12603.

## 7 7 20000 11670.pv <- sum(df$pv)

cat("We should be willing to pay",paste0("$",round(pv,2)),"for the first investment")## We should be willing to pay $52585.46 for the first investmentProblem 6B

cf2 <- c(rep(20000,3), 30000)

interest <- 8/100

df <- tibble(year = 1:length(cf2),

cf = cf2) %>%

mutate(pv = cf / (1 + interest)^ year)

cat("We should be willing to pay",paste0("$",round(pv,2)),"for the second investment")## We should be willing to pay $52585.46 for the second investmentProblems 7 to 15 and their solution in R

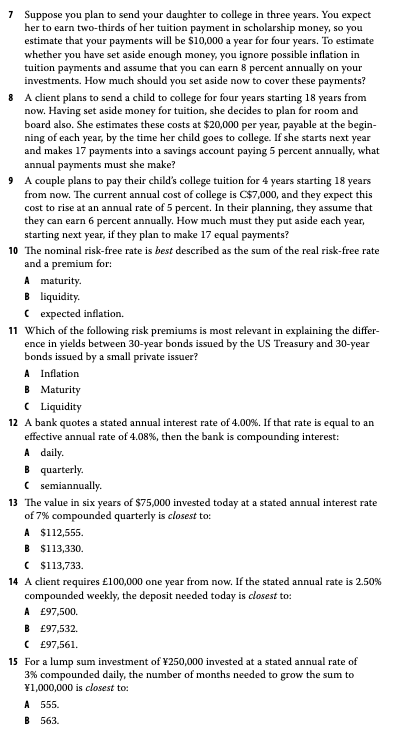

Problem 7

cf <- c(rep(0,2), rep(10000,4))

interest <- 8/100

df <- tibble(year = 1:length(cf),

cf = cf) %>%

mutate(pv = cf / (1 + interest)^ year)

print(df)## # A tibble: 6 x 3

## year cf pv

## <int> <dbl> <dbl>

## 1 1 0 0

## 2 2 0 0

## 3 3 10000 7938.

## 4 4 10000 7350.

## 5 5 10000 6806.

## 6 6 10000 6302.pv <- sum(df$pv)

cat("We should set aside", paste0("$",round(pv,2)), "today to pay for the college tuition")## We should set aside $28396.15 today to pay for the college tuitionProblem 8

# This is a two part problem

# First calculate the PV of

# Room and board required

# before college starts

cf1 <- rep(20000,4)

interest <- 5/100

df1 <- tibble(year = 1:length(cf1),

cf = cf1) %>%

mutate(pv = cf / (1 + interest)^ year)

fv <- sum(df1$pv)

cat("The client will need", fv,

"before college starts.")## The client will need 70919.01 before college starts.# Now we need to calculate the

# payment needed to get this

# Future value

# We will use the FV value of annuity formula

# FV = annuity((1 + r)^N - 1 / r)

# we need to make 17 payments

annuity <- fv / (((1 + interest)^17 - 1) / 0.05)

cat("The parent will need to make", paste0("$",round(annuity,2)), "to save for room and board")## The parent will need to make $2744.5 to save for room and boardProblem 9

# First we need to calculate the

# Inflation adjusted cost of college

# in the future

inflation <- 0.05

tuition_today <- 7000

college_start_years <- 18

tuition_fv_year1 <- (1 + inflation) ^ college_start_years * tuition_today

cat("Tuition will be", paste0("C$",round(tuition_fv_year1,2),

" for the first year, 18 years from now."))## Tuition will be C$16846.33 for the first year, 18 years from now.# Now lets calculate the tuition payments for the next 3 years

# Year 0 is

df <- tibble(year = 1:4,

tuition = c(tuition_fv_year1, rep(0,3))) %>%

mutate(tuition = (1 + inflation)^(year - 1) * tuition_fv_year1)

print(df)## # A tibble: 4 x 2

## year tuition

## <int> <dbl>

## 1 1 16846.

## 2 2 17689.

## 3 3 18573.

## 4 4 19502.# Now we need to PV these payments at

# beginning of year 17

interest <- 6/100 # Expected returns

df <- df %>%

mutate(pv = tuition / (1 + interest) ^ year)

fv_total_tuition <- sum(df$pv)

# Now its an annuity problem as before

annuity <- fv_total_tuition / (((1 + interest)^17 - 1) / interest)

annuity## [1] 2221.579cat("The couple will need to save", paste0("$",round(annuity,2)), "each year for the expected college tuition.")## The couple will need to save $2221.58 each year for the expected college tuition.Problem 10

C. expected inflation.

Problem 11

C. Liquidity

Problem 12

(1 + 0.04/365)^365 - 1## [1] 0.04080849A. daily

Problem 13

(1+0.07 / 4) ^ (4 * 6) * 75000## [1] 113733.2A. $113733

Problem 14

100000 / (1 + 0.025 / 52) ^ 52## [1] 97531.58B. 97532

Problem 15

# Get the Effective annual rate

rate <- (1 + 0.03 / 365) ^ 365 - 1

# Get the months

# needed to quadruple the PV

log(1000000 / 250000) / log(1 + rate) * 12## [1] 554.5405A. 555

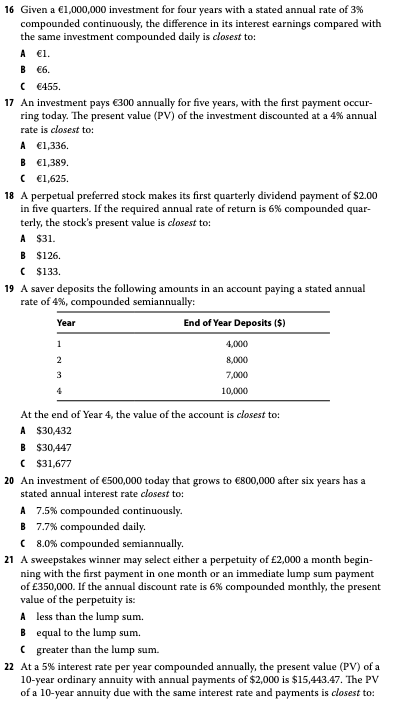

Problems 16 to 22 and their solution in R

Problem 16

# 3% continuously compounding

# for 4 years

continuous_compounding <- exp(0.03 * 4) * 1000000

daily_compounding <- (1 + 0.03 / 365) ^ (4 * 365) * 1000000

continuous_compounding - daily_compounding## [1] 5.55994B. €6

Problem 17

rate <- 4/100

pmt <- 300

years <- 5

pv <- (pmt / rate * (1 - 1/(1 + rate)^years)) * (1 + rate)

pv## [1] 1388.969B. $1389

Problem 18

quarterly_div <- 2

yearly_div <- quarterly_div * 4

# PV a year from now

fv <- yearly_div / 0.06

# Current price

pv <- fv / (1 + 0.06)

pv## [1] 125.7862B. $126

Problem 19

rate <- 4/100

ear <- (1 + rate / 2) ^ 2

df <- tibble(year = 1:4,

years_remaining = 4:1,

cf = c(4000, 8000, 7000, 10000)) %>%

mutate(fv = cf * ((1 + 0.02) ^ ((years_remaining - 1) * 2)))

df## # A tibble: 4 x 4

## year years_remaining cf fv

## <int> <int> <dbl> <dbl>

## 1 1 4 4000 4505.

## 2 2 3 8000 8659.

## 3 3 2 7000 7283.

## 4 4 1 10000 10000fv <- sum(df$fv)

fv## [1] 30446.91B. $30447

Problem 20

# continuously

cont <- exp(0.075 * 6) * 500000

# daily

d <- (1 + 0.07 / 365) ^ (6 * 365) * 500000

# Semiannually

s <- (1 + 0.08 / 2) ^ (6 * 2) * 500000

tibble(continuously = cont,

daily = d,

semiannually = s)## # A tibble: 1 x 3

## continuously daily semiannually

## <dbl> <dbl> <dbl>

## 1 784156. 760950. 800516.C. 8.0% compounded semiannually

Problem 21

perp_payment <- 2000 / (0.06 / 12)

perp_payment## [1] 4e+05C. greater than the lump sum

Problem 22

ordinary_annuity <- tibble(year = 1:10,

cf = 2000) %>%

mutate(pv = cf / (1 + 0.05) ^ year) %>%

summarise(s = sum(pv)) %>%

.[[1]]

annuity_due <- ordinary_annuity * 1.05

annuity_due## [1] 16215.64B. 16216

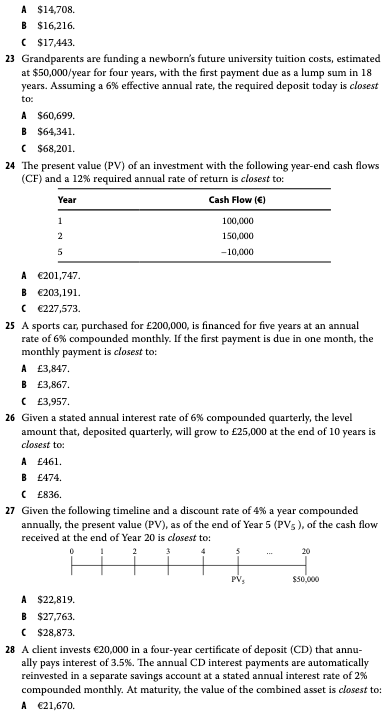

Problems 23 to 28 and their solution in R

Problem 23

rate <- 6/100

pmt <- 50000

years <- 4

# PV of ordinary annuity

# This is also the future value

fv <- (pmt / rate * (1 - 1/(1 + rate)^years))

# Calculate the PV

pv <- fv / (1 + rate) ^ 17

pv## [1] 64340.85B. 64341

Problem 24

rate <- 12/100

tibble(year = c(1,2,5),

cf = c(100000, 150000, -10000)) %>%

mutate(pv = cf / (1 + rate) ^ year) %>%

summarise(s = sum(pv)) %>%

.[[1]]## [1] 203190.5B. 203191

Problem 25

rate <- 0.06/12

n <- 12 * 5

pv_factor <- (1 - (1/(1+rate) ^ n)) / rate

payment <- 200000 / pv_factor

payment## [1] 3866.56B. 3866

Problem 26

rate <- 0.06 / 4

n = 4 * 10

25000 / (((1 + rate) ^ n - 1) / rate)## [1] 460.6775A. 460.68

(50000 / (1 + 0.04)^20) * (1 + 0.04) ^ 5## [1] 27763.23B. $27763

Problem 28

Answer choices are

- 21670

- 22890

- 22950

p <- 0.035 * 20000

p## [1] 700rate <- 0.02/12

n <- 4 * 12

fv_payments <- tibble(years_remaining = 3:0,

cf = p) %>%

mutate(n = years_remaining * 12) %>%

mutate(fv = (1 + rate) ^ n * cf) %>%

summarise(s = sum(fv))

20000 + fv_payments## s

## 1 22885.92B. 22890