How to calculate portfolio statistics in Python

In this post we will calculate the following portfolio statistics using Python.

- Portfolio average returns

- Portfolio standard deviation

- Portfolio Sharpe ratio

As usual we will start with loading our libraries.

import pandas as pd

import numpy as np

import matplotlib.pyplot as plt

import pandas_datareader as webWe will use the same assets from the last post to build our portfolio.

# Create a list of tickers and weights

tickers = ['BND', 'VB', 'VEA', 'VOO', 'VWO']

wts = [0.1,0.2,0.25,0.25,0.2]Next lets download the price data from yahoo finance. We will only keep the adjusted closing price for our stock tickers.

price_data = web.get_data_yahoo(tickers,

start = '2013-01-01',

end = '2018-03-01')

price_data = price_data['Adj Close']

Next we will calculate the daily returns for our assets.

ret_data = price_data.pct_change()[1:]After this we will calculate the portfolio returns.

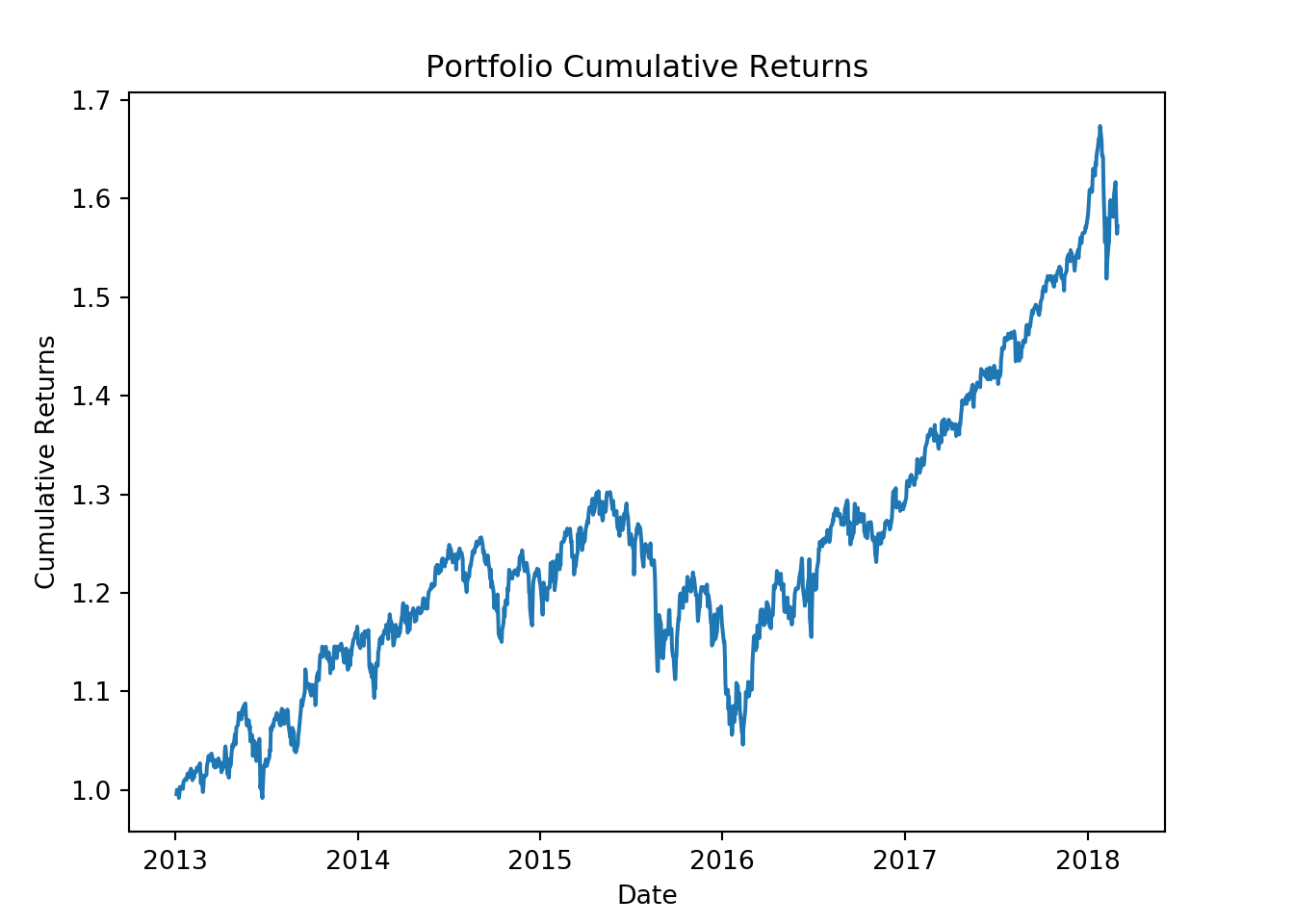

port_ret = (ret_data * wts).sum(axis = 1)Lets look at the total cumulative returns for our portfolio.

cumulative_ret = (port_ret + 1).cumprod()

fig = plt.figure()

ax1 = fig.add_axes([0.1,0.1,0.8,0.8])

ax1.plot(cumulative_ret)

ax1.set_xlabel('Date')

ax1.set_ylabel("Cumulative Returns")

ax1.set_title("Portfolio Cumulative Returns")

plt.show();

We now have the daily returns data. We will convert it to geometric average annual returns.

geometric_port_return = np.prod(port_ret + 1) ** (252/port_ret.shape[0]) - 1

print(geometric_port_return)## 0.09164978620705222Next we will calculate the portfolio standard deviation or volatility. This is the annual standard deviation for our portfolio.

annual_std = np.std(port_ret) * np.sqrt(252)

print(annual_std)## 0.12039589835434619Next we will calculate the portfolio Sharpe ratio.

port_sharpe_ratio = geometric_port_return / annual_std

print(port_sharpe_ratio)## 0.7612367818155304In this post we calculate the

- Portfolio annualized returns

- Portfolio standard deviation

- Portfolio Sharpe ratio